CHINA: BEHIND THE GREAT WALL (c) Leo Haviland June 7, 2016

“Seek truth from facts.” Mao Zedong and Deng Xiaoping

CONCLUSION

China’s era of miraculous economic growth has marched into history. Yet China’s real GDP output in the past few years, and even 2015, has been robust in comparison to that of most other nations. The majority of international financial wizards faithfully proclaim that Chinese GDP likely will remain strong, at over six percent for the next several years.

China’s GDP strength over the past three or four years nevertheless derived significantly from its widespread national willingness to boost debt (leverage) levels substantially. This significant debt expansion coincides with the current unwillingness or inability of the nation’s political and economic leadership to do much to subdue the debt issue. China’s continued debt building (perhaps assisted by other factors) perhaps will achieve its praiseworthy growth levels, at least for a while.

And trend shifts during first quarter 2016 in various stock (both advanced and emerging), interest rate, currency, and commodity marketplaces (particularly dramatic rallies in the S+P 500 and the petroleum complex) inspire optimism regarding global growth prospects. Despite potential for small rate increases by the widely-admired Federal Reserve, monetary policy in America and elsewhere likely will remain highly accommodative, thereby assisting expansion in developed nations and China.

****

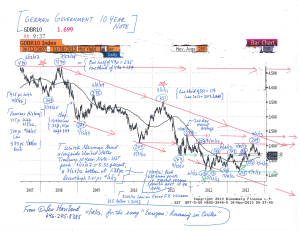

However, review the patterns in China’s stock, central government 10 year note, and currency marketplaces. Those domains, when interpreted together and alongside a broad array of other key global financial marketplaces, not just the S+P 500 and oil, on balance nowadays suggest Chinese growth over the next few years probably will be less than most gurus expect. In today’s interconnected economic world, slower than anticipated Chinese economic expansion probably will be reflected by more sluggish growth elsewhere than generally forecast.

Politics and economics entangle in both advanced and emerging/developing nations. China’s political elite (notably its Communist party chiefs) seeks to ensure its own power and overall national political, economic, and social stability. Insufficient GDP growth and related widespread popular fears regarding income levels and economic inequality probably endangers these goals.

What do the political rhetoric and actions over the past few years (including recently) by China’s leaders reflect? Quite significantly, they portray increasing concern about their nation’s current and prospective economic situation, particularly its growth level and outlook.

To deflect and dilute growing popular concern about a weakening economic situation (slowdown; feebler growth than desired), and to maintain their political power and influence, China’s political leaders have acted vigorously on both the external and internal fronts. In the foreign sphere, they increasingly quarrel with other nations; on the internal landscape, efforts to control political and other social activities and dialogue have increased. These policies from China’s authorities tend to confirm the trends of slowing Chinese (and global) growth.

FOLLOW THE LINK BELOW to download this article as a PDF file.

China- Behind the Great Wall (6-7-16)