WE CAN’T GET NO SATISFACTION: CULTURAL TRENDS AND FINANCIAL MARKETPLACES © Leo Haviland July 13, 2022

In “Satisfaction”, The Rolling Stones sing: “I can’t get no satisfaction.”

****

CONCLUSION AND OVERVIEW

“Economic” confidence and satisfaction levels and trends interrelate with patterns of and anticipations regarding “economic” performance. These variables entangle with and influence price trends in stocks and other financial marketplaces. Thus consumer (Main Street) confidence and similar measures can confirm, lead (or lag), or be an omen for future movements in GDP, inflation, the S+P 500, interest rates, and so on.

Declines in American economic confidence in recent times confirm deterioration in the nation’s (and global) economic condition. The severity of those confidence slumps probably warns of further ongoing economic challenges in the future. These looming difficulties include not only the perpetuation of relatively high inflation for quite some time, but also slowing and perhaps even falling GDP growth. Since America is a leading economic nation in the intertwined global economy, what happens there substantially influences and reflects economic performance elsewhere.

****

Regarding and within cultural fields, definitions, propositions, interpretations, arguments, and conclusions are subjective (opinions). So-called “economic” (financial, commercial, business) arenas and analysis regarding them are not objective (scientific). In any case, as they are cultural phenomena, economic realms are not isolated from “political” and “social” ones. They interrelate with them, and sometimes very substantially.

Evidence of substantial (and in recent times, increasing) “overall” (including but not necessarily limited to political or economic) dissatisfaction within America are not unique to that country. However, since overall and political measures of declining confidence within and regarding the United States both include and extend beyond the economic battleground, at present they consequently probably corroborate current and herald upcoming economic troubles (economic weakness; still rather lofty inflation) for the US.

****

Marketplace history is not marketplace destiny, either entirely or even partly. Relationships between marketplaces and variables can change, sometimes dramatically. Nevertheless, keep in mind that if prices for assorted “search for yield (return)” marketplaces such as stocks (picture the S+P 500) and lower-grade debt can climb “together” (roughly around the same time), they also can retreat together.

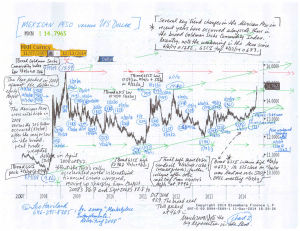

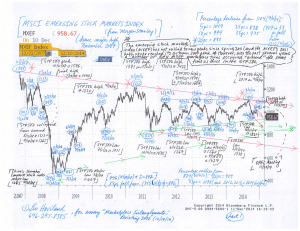

“Runs for cover” in recent months increasingly have replaced “searches for yield” in the global securities playground by worried “investors” and other nervous owners. Price declines in American and other stock marketplaces have interrelated with higher yields for (price slumps in) corporate debt securities and emerging marketplace sovereign US dollar-denominated notes and bonds.

The devastating price collapse in Bitcoin and many other cryptocurrencies surely has dismayed many yield-hunters on Main Street.

Declines in American confidence and satisfaction assist and confirm the price falls in recent months in the S+P 500 and other “search for yield” playgrounds such as corporate and low-grade sovereign debt. Thus confidence destruction has interrelated with capital destruction (loss of money) by “investors” and other owners) in stock and interest rate securities marketplaces. From the historical perspective, slumps in as well as very low levels for some of the confidence (“happiness”; optimism) indicators probably signal further price drops in the S+P 500 and interconnected search for yield marketplaces.

****

The beloved Federal Reserve and its central banking friends finally recognized that consumer price inflation is not a temporary or transitory phenomenon and have elected to raise policy rates (end, or at least reduce, yield repression) and shrink their bloated balance sheets. Yet inflation probably will not drop significantly for some time. Besides, how much faith exists that the Federal Reserve will (or can) control and even reduce consumer price inflation anytime soon? How much trust should we place in the Fed’s abilities? The Fed helped to create inflation (and not just in consumer prices, but also in assets) via its sustained massive money printing and ongoing yield repression, and the Fed did not quickly perceive the extent and durability of consumer price inflation.

Long run history shows that significantly rising American interest rates for benchmarks such as the US Treasury 10 year note lead to bear marketplaces in the S+P 500.The US stock marketplace has declined significantly since its January 2022 peak. Home price appreciation, a key factor pleasing many consumers, probably will decelerate, and perhaps even cease. The Ukraine/Russia war continues to drag on. Despite recent declines from lofty heights, prices for commodities in general remain elevated from the pre-war perspective. Global government debt is substantial, and fearsome long-run debt problems for America and many other countries beckon. American and international GDP growth has slowed. Stagflation and even recession fears have increased. The coronavirus problem, though less terrifying, has not disappeared.

Therefore many American Main Street confidence indicators probably will decline, or at least remain relatively weak, over at least the next several months.

****

FOLLOW THE LINK BELOW to download this article as a PDF file.

We Can't Get No Satisfaction- Cultural Trends and Financial Marketplaces (7-13-22)